Moody's Investors Service says that Reliance Communications (RCOM)'s announced transaction to sell its tower assets, held under its subsidiary, Reliance Infratel (RITL, unrated) when consummated will substantially improve the company's financial profile and support its Ba3 ratings and stable outlook.

Moody's Investors Service says that Reliance Communications (RCOM)'s announced transaction to sell its tower assets, held under its subsidiary, Reliance Infratel (RITL, unrated) when consummated will substantially improve the company's financial profile and support its Ba3 ratings and stable outlook.

On December 4, RCOM announced the signing of a non-binding Term Sheet with Tillman Global Holdings, LLC and TPG Asia, Inc. in relation to the proposed acquisition of RCOM's nationwide tower assets and related infrastructure by Tillman and TPG.

On December 4, RCOM announced the signing of a non-binding Term Sheet with Tillman Global Holdings, LLC and TPG Asia, Inc. in relation to the proposed acquisition of RCOM's nationwide tower assets and related infrastructure by Tillman and TPG.

Based on precedent tower transactions in India, we expect a transaction value of about Rs 220 billion (USD 3.35 billion) for the sale of approximately 43,500 towers owned by RITL. We assume certain debt will be transferred to the new tower company, and RCOM will use the remaining sales proceeds to reduce balance sheet debt.

"While RCOM's operating costs for its towers will decline, its rental costs for leasing back the towers will increase its consolidated lease expense, which we capitalize and add to gross debt. However, given the lease rentals for towers in India are relatively low, there will be a substantial reduction in RCOM's adjusted gearing," says Nidhi Dhruv, a Moody's Assistant Vice President.

Given RCOM's public commitment to use the sales proceeds only for debt reduction, the transaction will enable the company to meet its deleveraging target of around 4.0-4.5x for its rating level before the fiscal year ending March 2017.

"Cash proceeds from the sale of towers will also alleviate liquidity and refinancing pressures for RCOM. However, we note that the company needs to obtain approvals from banks and bond holders to carve out the tower assets from the respective collateral packages," adds Dhruv, also Moody's Lead Analyst for RCOM.

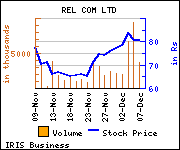

Shares of the company declined Rs 2.15, or 2.66%, to settle at Rs 78.75. The total volume of shares traded was 1,544,011 at the BSE (Tuesday).